Consulting

Welcome Volarus

Welcome Volarus

The Premier

Lender For Real Estate Investments

We offer customized loan solutions to help you make informed financial decisions, optimize investments, and achieve long-term growth.

LOAN PROGRAMS

LOAN PROGRAMS

LOAN PROGRAMS

We provide expert financial solutions tailored to your unique needs, enabling you to achieve sustainable growth and long-term success.

Why Choose Us

Why Choose Us

Empowering You with Flexible Loan Solutions

We provide hassle-free financing solutions tailored to your needs, ensuring you secure the best loan with confidence and ease.

- Referrals Valued & Brokers Protected

- Closing in As Few As 10 Business Days

- Common Sense Underwriting with In-House Approvals

- Committed to the Highest Level of Customer Service

AWARDS

AWARDS

AWARDS & ACCOLADES

About Us

About Us

Crafting Smart Financial Solutions for Your Success

We take a personalized approach to every loan, working closely with clients to understand their unique financial needs and opportunities.

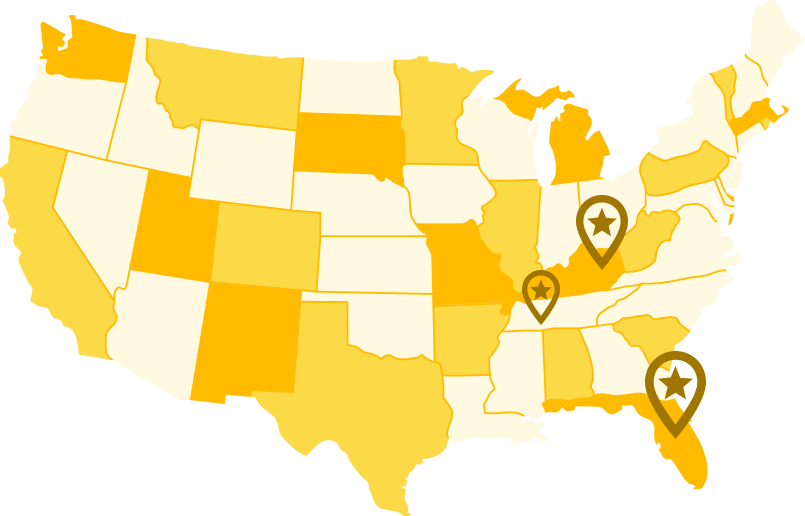

Read More AREAS

AREAS

VOLARUS LENDING AREAS

Our Working Process

Our Working Process

Simple Steps to Secure Your Loan

We follow a streamlined approach to ensure you get the best financing solutions tailored to your unique needs.

Initial Consultation

We assess your financial goals and explore the best loan options for you.

Implementation

We process your loan application efficiently, ensuring a smooth approval experience.

Tailored Planning

Our experts create a personalized loan strategy that aligns with your requirements.

Review & Optimize

We continuously monitor and refine your loan structure for maximum benefits.

How Its Works

Initial Consultation

We assess your financial goals and explore the best loan options for you.

Implementation

We process your loan application efficiently, ensuring a smooth approval experience.

Tailored Planning

Our experts create a personalized loan strategy that aligns with your requirements.

Review & Optimize

We continuously monitor and refine your loan structure for maximum benefits.

How Its Works

What Our Clients Say

What Our Clients Say

Our Success Stories

We’ve designed a streamlined approach to ensure you get the best results, tailored to your specific needs.

I was in urgent need of financial assistance, and this loan lending service came to my rescue! The application process was smooth, the approval was quick, and the interest rates were reasonable. Their team guided me through every step, ensuring transparency and ease. Within 24 hours, I had the funds in my account! I highly recommend their service to anyone looking for a hassle-free loan experience. Truly a lifesaver!

Ralph Edwards

Marketing Coordinator

Buying our dream home seemed impossible until we found this loan lending service. The entire process was seamless, from application to approval. The team was incredibly supportive, answering all our questions with patience and clarity. Within days, we had the funds, and now we are proud homeowners! Highly recommend their efficient and reliable service!

Emma Johnson

Real Estate Consultant

I had been struggling to find a home loan with reasonable interest rates, but this service exceeded my expectations! The online application was simple, and I received approval much faster than I anticipated. Their transparent policies and helpful team made the process stress-free. Thank you for making my home-buying journey smooth!

Daniel Smith

Financial Advisor

As a first-time homebuyer, I was nervous about the entire loan process. However, this service made everything so easy! They explained each step, ensured I got the best interest rate, and processed my loan quickly. Within no time, I had the keys to my new home. Highly recommended for anyone seeking a hassle-free loan experience!

John Wick

HR Manager

I needed urgent financial support to secure my new house, and this loan lending service delivered beyond my expectations. The approval was fast, and the terms were fair. Their team guided me throughout, making everything smooth and stress-free. If you need a home loan, don’t think twice—this is the best service out there!

Michael Brown

Entrepreneur

FAQs

FAQs

Frequently Asked Questions

Got Questions? We have answers

If you're already working with Volarus Capital Partners, we recommend reaching out directly to your assigned loan officer for the most accurate assistance. If you're a new client or have general questions, feel free to contact us at: 📧 Email: Info@volaruscp.com Contact Us for More Information

Loan servicing for Volarus Capital Partners is managed by Elite Commercial Servicing. For any questions related to loan servicing, please use the following contact information: 📧 Email: Info@volaruscp.com

Volarus Capital Partners is an asset-based lender. This means your loan amount is primarily based on the value of the real estate asset used as collateral. Maximum Loan-to-Value (LTV) ratios vary depending on the loan program. For detailed information, please refer to the “Loan Programs” section on our website.

To evaluate both the borrower and the property, we require the following: Completed loan application, Authorization for credit and background check, Proof of funds (e.g., bank statements), Property appraisal, Renovation budget (if applicable), Lease agreements (if applicable), Business entity documentation,

Yes, our minimum credit score requirements vary by program: Short-Term Bridge & ARV Loans: 660+, Long-Term Rental Loans: 660+, New Construction Loans: 650+, While credit score is a factor, we also review your full financial history and exit strategy to assess creditworthiness.

No, we do not charge application or processing fees during the pre-approval or approval stages. However, borrowers are responsible for third-party expenses, such as appraisals or project feasibility reports.